ATM, an Automatic Teller Machine, a machine that is widely by people used all over the world for withdrawing or depositing cash into their banking accounts.

Whenever we are in a need of cash, we just stopped by an ATM, insert a plastic card, enter a pin and leave with a physical form of currency "Cash." But do we ever think of how this machine works, how does it provide you money with a receipt, how does that network work which controls all the transactions by ATM machine?

Whenever we are in a need of cash, we just stopped by an ATM, insert a plastic card, enter a pin and leave with a physical form of currency "Cash." But do we ever think of how this machine works, how does it provide you money with a receipt, how does that network work which controls all the transactions by ATM machine?Automatic Teller Machine is an electronic device that is used by bank customers for their account transactions. Generally, there are two types of ATMs. One which is basic and used to draw cash or to get a report of the account balance. Another one is more complex, which can also be used to deposit cash and provide credit card payment facilities. Let's see the working of this machine...

Working of ATM:-

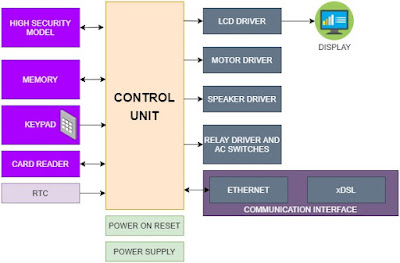

The ATM machine consists of two input and four output devices.

Input Devices:-

1) Card Reader:-

This device is used for the identification of a particular account number. There are two sensors in the card reader that can see what our eyes can't. When we insert or swiped our card in the card reader, those two readers/sensors detect that binary code, encoded in that magnetic strip at the backside of the card. One sensor will look for the special code that confirms the card is legit or not. The second reader will grab the account number and other information to check against what we've just keyed in. The captured data from the card is then passed to the host processor(server) which will use this data to get the information of the account holder.

2) Keypad:-

When the card is recognized, it asked for some input like what we want to do with the card. For eg. cash withdrawal, balance inquiry, mini-statement, language selection. Rather than all these options, first, we need to enter a personal identification number (PIN). If we entered that pin correctly and it matches the details fetched by the host processor from the bank account, it will permit us to do the rest of the things. There are discrete and separate laws to secure the PIN while sending it to the host processor.

Output Devices:-

1) Cash Dispenser:-

As it's all about the cash in hand, a cash dispenser should very precise and highly efficient. There are the main functions that should be done by a cash dispenser at the end of one complete process.

As it is the central system of an ATM machine, the cash dispenser should count each bill and cash and handed the customer with the required amount. There are many trays in the vault. Some of them are assigned to different types of denominations. One tray is kept empty for the deposit for the cheques, cash or demand draft (DD), which can be manually sorted later. There is a reject bin also which grabs up all the money that is rejected during sorting.

Some machines one can take deposits without an envelope. They are able to hand count bills, this also allows the machine to refill itself. For withdrawal, a vacuum-driven suction cups system is used which grab one bill at a time and feeds it out through a roller system delivering bills one by one from the vault, keeps you away from getting overpaid. This machine is a very careful counter as each bill goes through these rollers sensors, calculates the width of the paper about the thickness of a coat of paint. Any thicker the machine figures that two or more bills are stuck together or some bill is folded. Any thinner, the bills are worn or fake. Either way, the sensors will detect it and the bills get sent to a reject bin. That's likely what's happening when we hear a pause in the machines.

It is also required to keep the record of all transactions which are done by the real-time clock (RTC) device.

2) Receipt Printer:-

Receipt Printer is used to print a paper receipt with all details like the date and time of the transaction, the amount left in the account after the last withdrawal and all other required information.

3) Speaker:-

Speaker will provide you the feedback on what you need to do next, why you've done. For eg. "Please enter the amount of cash you want to withdraw", "Collect your receipt", etc.

4) Display Screen:-

As the name suggests, a display screen is used to display all the transaction information and prompts the cardholder through each step of the transaction. The LCD screen is made of either CRT or LED. Nowadays, the LCD screen is also coming up with a touch feature in it.

ATM Networking:-

There is a host processor which connects all the machines to their banks. This also makes possible to connect a card of a different bank to the machine of a different bank. Host Processor is necessary so that it can connect to the bank and ATM machine and also the customer requesting for cash. Hence to connect the machine with the host processor and host processor with the bank, Internet Service Provider (ISP) comes into the role. This will set up all the communication required for one complete transaction.

Settling of funds can also be done by the host network through electronic funds.

Two Types of ATM Machines:-

1) Leased Line ATM machine:-

A four wired, point to point dedicated telephone line helps a machine to directly connect through the host processor. It is costly so it is used where traffic is high because of their thru-put capabilities.

2) Dial-Up ATM:-

It is a normal dial-up connection that connects the host processor and machine through a modem. It is very cheap and the monthly cost is just a fraction of that of leased-line one.

So that's all about the working of the ATM machine.

1 Comments

I was searching for loan to sort out my bills& debts, then i saw comments about Blank ATM Credit Card that can be hacked to withdraw money from any ATM machines around you . I doubted thus but decided to give it a try by contacting {Blankatmoffice@gmail.com} they responded with their guidelines on how the card works. I was assured that the card can withdraw $5,000 instant per day & was credited with $50,000.00 so i requested for one & paid the delivery fee to obtain the card, after 24 hours later, i was shock to see the UPS agent in my resident with a parcel{card} i signed and went back inside and confirmed the card work's after the agent left. This is no doubts because i have the card & has made used of the card. This hackers are USA based hackers set out to help people with financial freedom!! Contact these email if you wants to get rich with this Via: Blankatmoffice@gmail.com...

ReplyDeleteWESTERN UNION HACK/ MONEY GRAM HACK 2) BITCOIN INVESTMENTS HACK 3) BANKS TRANSFERS 4) CRYPTOCURRENCY MINING 5) BANKS LOGINS 6) LOADING OF ACCOUNTS 7) WALMART TRANSFERS 8) BUYING OF GIFT CARDS 9) REMOVING OF NAME FROM DEBIT RECORD AND CRIMINAL RECORD 10) BANK HACKING 11) PAYPAL LOADING 12) CASH-APP FLIP •